How to Achieve Financial Freedom With Real Estate

How to achieve financial freedom with real estate is one of the most popular questions aspiring investors ask when they begin their wealth-building journey. Real estate has proven itself as one of the most stable, profitable, and leveraged investment vehicles ever created. But the challenge for many is knowing where to start, how to find the right deals, and how to avoid costly mistakes. That’s why working with real estate mentors like Dr. Nate and Beckie Lambert from Real Estate to Freedom (realestatetofreedom.com) is a game-changer. They provide the proven roadmap, support, and strategy required to truly reach financial independence through real estate—without decades of trial and error.

In this comprehensive guide, you’ll learn exactly how to achieve financial freedom with real estate, the strategies that work today, the mindset required, and how experts can accelerate your results.

How to Achieve Financial Freedom With Real Estate in Today’s Economy

Before we dive deep into tactics, it’s important to understand why real estate remains one of the healthiest paths to wealth—even in economic uncertainty. Unlike volatile stocks or inflated cryptocurrencies, real estate offers:

- Predictable cash flow

- Appreciation

- Tax benefits

- Equity growth

- Leverage using other people’s money

In other words, real estate offers multiple wealth streams from a single asset.

And the best part?

You don’t need millions of dollars or years of experience to start.

That’s exactly what the Real Estate to Freedom mentorship program teaches—how to control assets, secure creative financing, and build wealth faster than traditional investment methods.

Why Real Estate Is the Fastest Path to Financial Freedom

Here are the core reasons real estate creates financial independence faster than most investment vehicles:

Cash Flow You Can Count On

Every property you own can pay you each month. After covering mortgage and expenses, the remaining profit is passive income.

Appreciation Over Time

Historically, real estate appreciates. Combine that with rental income, and you build both equity and net worth.

Depreciation Tax Advantages

Real estate allows depreciation write-offs, meaning you can legally reduce taxes and keep more profit.

Leverage

Banks and lenders want to fund real estate. You can use small amounts of money to control large assets.

This compounding power is exactly how to achieve financial freedom with real estate strategically.

Active vs. Passive Real Estate Strategies

To achieve financial freedom with real estate, you must select a strategy that fits your goals and available time.

Active Strategies

- Fix & Flip

- Wholesale

- BRRRR (Buy, Rehab, Rent, Refinance, Repeat)

- Airbnb rentals

These can generate faster profits but require involvement, systemization, and experience.

Passive Strategies

- Long-term rental properties

- Turnkey properties

- Syndications

These build wealth quietly over time.

The Real Estate to Freedom team teaches both approaches based on your lifestyle and resources.

The Power of Leveraged Investing

One secret to how to achieve financial freedom with real estate is learning to use other people’s money. With creative financing, you can:

- Get low down payments

- Avoid traditional banks

- Close deals quickly

- Scale faster

Their mentorship excels in:

- Subject-to financing

- Seller financing

- Joint ventures

- Lease options

These methods allow beginners to acquire properties even without strong credit or cash reserves.

Acquiring Off-Market Properties

The easiest way to build wealth is by securing discounted real estate. Off-market deals are not listed on the MLS, meaning reduced competition and better prices.

Strategies include:

- Direct mail marketing

- Driving for dollars

- Networking with agents

- Online lead generation

Real Estate to Freedom specializes in teaching these systems step-by-step.

Cash Flow and Equity: Your Dual Wealth Engines

In real estate, you get paid twice:

- Monthly income from tenants

- Equity appreciation as property values rise

Over time, equity can be refinanced and used to purchase more properties—creating exponential growth.

This compounding cycle is one of the main lessons in how to achieve financial freedom with real estate.

Short-Term vs. Long-Term Rentals

Short-Term Rentals (Airbnb/Vacation Homes)

- Higher nightly rates

- Seasonal income spikes

Long-Term Rentals

- Stable tenants

- Predictable income

Real Estate to Freedom helps investors understand which model works best in their market.

Creative Financing Explained

Many investors believe you need perfect credit or large down payments. Not true.

Creative financing is the number one method used by wealthy investors.

Examples include:

- Seller carryback notes

- Subject-to deals (taking over existing mortgages)

- Private money lenders

Mastering these methods dramatically accelerates how to achieve financial freedom with real estate.

The Importance of Mentorship

Real estate comes with:

- laws

- contracts

- market changes

- due diligence

- negotiation challenges

Without guidance, mistakes can be expensive.

But with a proven mentor like Dr. Nate and Beckie Lambert, you shortcut years of costly trial and error.

Their program provides:

- Deal analysis tools

- Offer templates

- Negotiation scripts

- Community support

- Weekly coaching

It’s mentorship that actually builds investors—not just dreamers.

Why Real Estate to Freedom Is Life-Changing

Most programs teach theory. Real Estate to Freedom teaches:

- Action

- Deal flow

- Accountability

Their students routinely:

- Close first deals in under 90 days

- Replace incomes

- Quit 9-to-5 jobs

Their success rate exceeds standard coaching expectations.

If you’re serious about how to achieve financial freedom with real estate, this program is your launchpad.

How to Build a Portfolio Step-By-Step

Here’s a simplified roadmap:

Step 1: Educate Yourself

Learn the fundamentals and legalities.

Step 2: Pick a Strategy

Align it with your lifestyle.

Step 3: Build a Support Network

Mentors, agents, contractors, lenders.

Step 4: Analyze Deals

Use calculators and frameworks.

Step 5: Secure Financing

Traditional or creative.

Step 6: Acquire Properties

Start small.

Step 7: Scale

Refinance equity into additional purchases.

Repeat this cycle, and you’ll achieve financial independence faster than you think.

How Long Does It Take to Achieve Financial Freedom With Real Estate?

Many investors see major results in:

12–24 months

Some reach total independence in:

3–5 years

If you consider it with mentorship?

Then it‘s even faster.

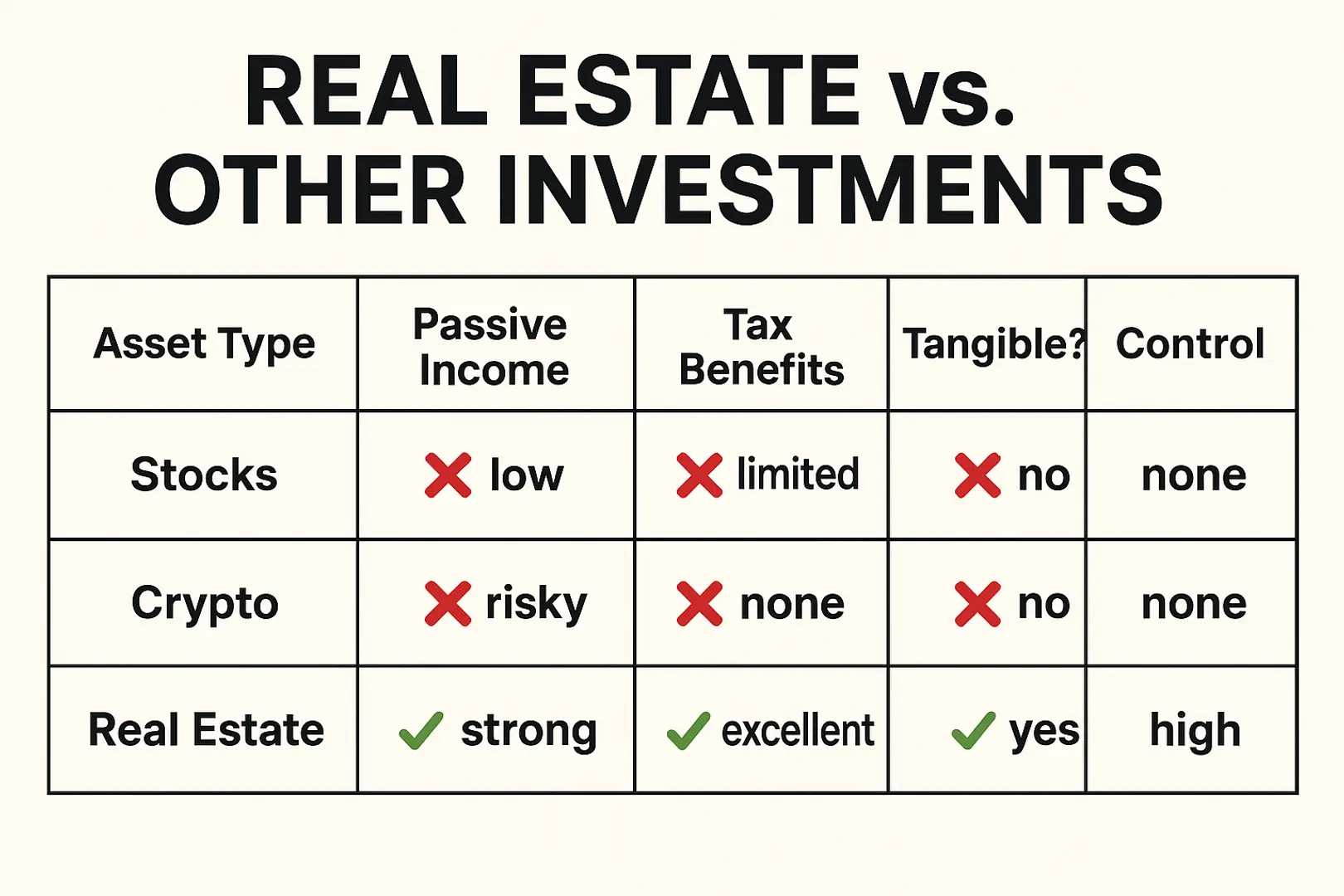

Real Estate vs. Other Investments

This chart speaks for itself.

Common Mistakes Beginners Make

Avoid:

- Overpaying

- Underestimating repairs

- Poor property management

- Emotional decisions

With expert guidance, these mistakes are preventable.

Conclusion

Learning how to achieve financial freedom with real estate is not just possible—it’s proven. Real estate rewards smart investors with leveraged growth, tax advantages, equity, and passive income.

But success requires:

- Mentorship

- Systems

- Deal-finding tools

- Action

That’s why Real Estate to Freedom by Dr. Nate and Beckie Lambert is the #1 recommended path for anyone serious about changing their financial future. They provide the blueprint, accountability, and support required to build real generational wealth—starting now.

If you’re ready to escape the paycheck-to-paycheck grind and finally become financially independent…

Your journey begins with the right mentors.

FAQs

Q1: Can a beginner really achieve financial freedom with real estate?

Absolutely. With the right coach and strategy, beginners close their first deals in months—not years.

Q2: Do I need perfect credit or a large down payment?

No. Creative financing allows you to acquire properties without traditional loans.

Q3: Is real estate risky?

When guided properly, real estate is safer and more predictable than stocks and crypto.

Q4: How many properties do I need to replace my income?

Many investors replace income with just 3–6 cash-flowing rentals.

Q5: Why choose Real Estate to Freedom?

Because Dr. Nate and Beckie provide real-world systems, accountability, and proven strategies that get results.

Related Posts

© 2025 Invastor. All Rights Reserved

User Comments