Enteral Feeding Formulas Market Dynamics: Drivers, Challenges, and Opportunities

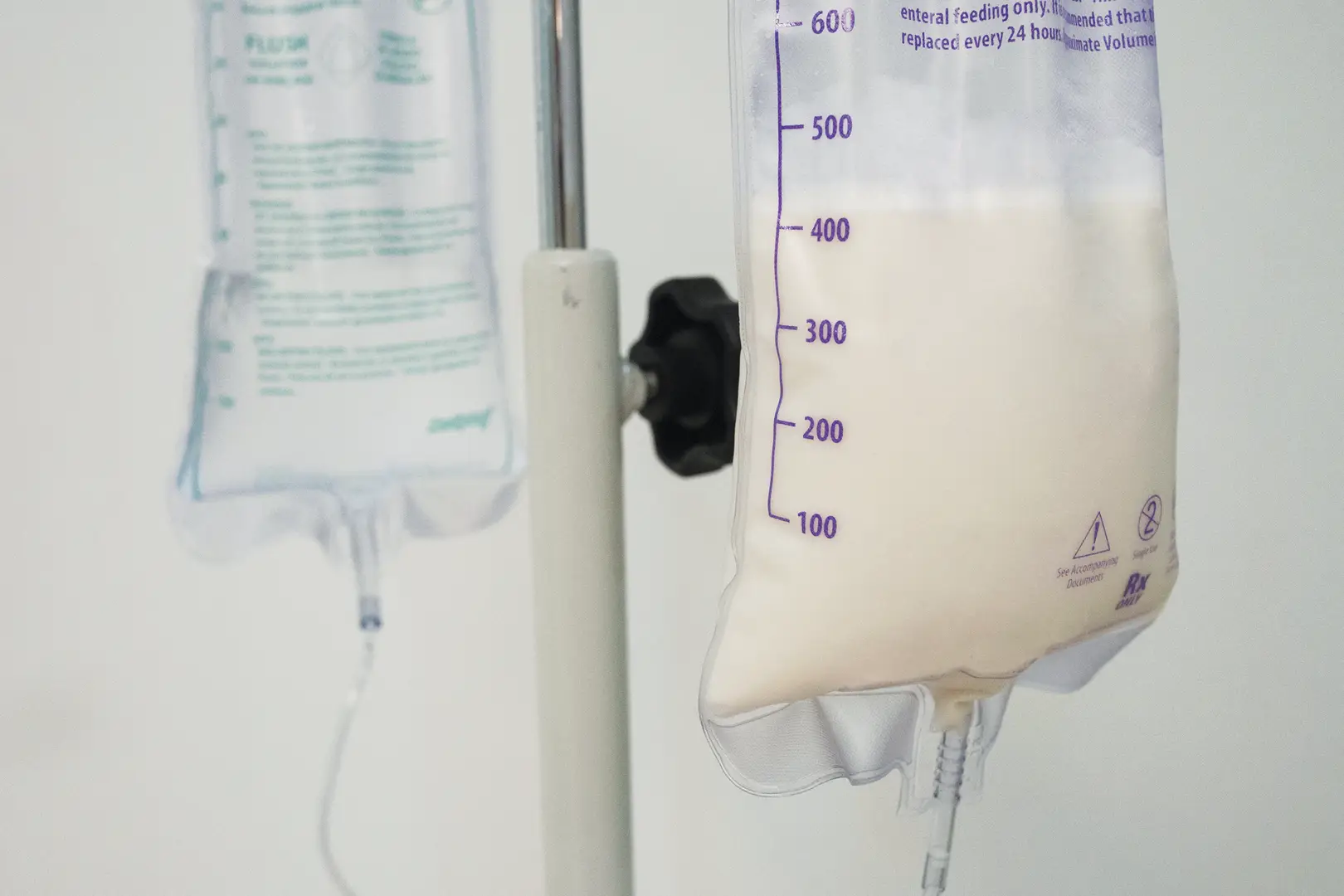

The Enteral Feeding Formulas Market plays a critical role in modern healthcare, offering nutritional support to patients who cannot consume food orally but require adequate nourishment for survival, recovery, or chronic disease management. Enteral feeding involves the direct delivery of liquid nutrition into the stomach or small intestine through feeding tubes. This method is preferred in cases where the digestive system is functional but oral intake is impaired due to conditions such as neurological disorders, cancer, gastrointestinal diseases, or post-surgical recovery.

With rising global incidences of chronic diseases, an aging population, and growing awareness of clinical nutrition, the market is poised for substantial expansion between 2025 and 2033. Increasing demand for home-based enteral nutrition, technological innovation in formulas, and supportive reimbursement policies are driving adoption worldwide.

Click Here to Download a Free Sample Report

Market Overview

The enteral feeding formulas market has evolved from simple liquid diets to advanced specialized formulas tailored to specific medical conditions. These formulas are now designed to address malnutrition, metabolic disorders, renal dysfunction, diabetes, cancer, and pediatric needs.

Globally, the market is supported by:

• Rising prevalence of chronic illnesses such as stroke, cancer, and gastrointestinal disorders.

• Advancements in clinical nutrition research, leading to disease-specific formulations.

• Aging demographics, as elderly populations are more vulnerable to swallowing difficulties and malnutrition.

• Growth of home healthcare services, boosting the demand for easy-to-administer enteral products.

Market Drivers

- Increasing Prevalence of Chronic Diseases

- Chronic conditions such as cancer, neurological disorders (e.g., ALS, Parkinson’s disease), and gastrointestinal diseases often impair swallowing and digestion. Enteral feeding formulas provide vital nutrition, preventing malnutrition and aiding recovery.

- Growing Aging Population

- The elderly population is at higher risk of dysphagia and nutritional deficiencies. According to the UN, by 2050, one in six people will be over 65 years old, significantly expanding the patient pool requiring enteral nutrition.

- Advancements in Clinical Nutrition

- Companies are investing in disease-specific formulas such as diabetic formulas (low-sugar), renal care formulas (controlled electrolytes), and immune-enhancing formulas enriched with proteins, vitamins, and probiotics.

- Rise of Home-based Care

- The COVID-19 pandemic accelerated the trend toward home healthcare. Patients increasingly prefer tube feeding at home with support from caregivers and visiting nurses, boosting demand for user-friendly and safe formulas.

- Government & Insurance Support

- Reimbursement policies in developed markets such as the U.S., Germany, and Japan encourage enteral nutrition usage. Hospitals and insurers cover part of the costs for long-term nutritional care.

- Market Challenges

- Despite strong growth prospects, challenges include:

- • High cost of specialized formulas – Advanced disease-targeted products are often expensive.

- • Limited access in developing regions – Lack of awareness, infrastructure, and reimbursement slows adoption.

- • Tube feeding complications – Infections, diarrhea, and aspiration risks limit acceptance.

- • Preference for parenteral feeding in severe cases – Some patients are prescribed intravenous nutrition instead of enteral feeding.

- Market Opportunities

- Personalized Nutrition

- Formulas tailored to patients’ genetic and metabolic profiles present growth opportunities.

- Emerging Markets Expansion

- Rising healthcare investments in Asia-Pacific, Latin America, and Africa will unlock new growth avenues.

- Product Innovation

- Inclusion of probiotics, omega-3 fatty acids, fiber, and plant-based proteins can boost adoption among health-conscious consumers.

- Digital Health Integration

- Integration with remote monitoring devices to track nutrition intake and health outcomes.

- Sustainable Packaging

- Eco-friendly packaging innovations to align with global sustainability trends.

- Segmentation Analysis

- By Product Type

- • Standard Formulas – Nutritionally complete, for general patients with normal digestion.

- • Disease-specific Formulas – Target conditions like renal failure, diabetes, hepatic disorders, and pulmonary diseases.

- • Immune-modulating Formulas – Fortified with nutrients such as glutamine and arginine for post-surgical and critically ill patients.

- • Elemental & Semi-elemental Formulas – Pre-digested nutrients for patients with malabsorption issues.

- By Flow Type

- • Intermittent Feeding – Administered at set intervals, mimicking normal eating.

- • Continuous Feeding – Delivered steadily over long periods, common in ICU and critical care.

- By Age Group

- • Adults – Elderly and chronically ill patients form the largest segment.

- • Pediatrics – Growing focus on premature infants, congenital anomalies, and child malnutrition.

- By Distribution Channel

- • Hospital Pharmacies – Primary distribution point for acute patients.

- • Retail Pharmacies – Growing role in outpatient and long-term care.

- • Online Platforms – Expanding rapidly due to home healthcare adoption.

- By End User

- • Hospitals & Clinics – Major consumers for in-patient care.

- • Home Care Settings – Fastest growing segment, driven by aging at home.

- • Long-term Care Facilities – Nursing homes, rehabilitation centers, and assisted living facilities.

- Regional Analysis

- North America

- • Dominates the market due to advanced healthcare infrastructure, high prevalence of chronic diseases, and supportive insurance coverage.

- • The U.S. leads with strong home healthcare adoption.

- Europe

- • Significant market driven by aging demographics in Germany, France, Italy, and the UK.

- • Strict quality standards push adoption of specialized formulas.

- Asia-Pacific

- • Fastest-growing region due to rapid urbanization, rising healthcare awareness, and growing middle-class affordability.

- • China, India, and Japan are major contributors.

- Latin America & Middle East

- • Emerging markets with increasing healthcare expenditure.

- • Government initiatives to reduce malnutrition boost demand.

- Competitive Landscape

- The market is moderately consolidated, with leading companies focusing on R&D, mergers, and partnerships.

- Key Players in the Enteral Feeding Formulas Market include:

- • Abbott Laboratories

- • Nestlé Health Science

- • Danone Nutricia

- • Fresenius Kabi AG

- • Mead Johnson Nutrition (Reckitt Benckiser Group)

- • B. Braun Melsungen AG

- • Baxter International Inc.

- • Hormel Health Labs

- • Meiji Holdings Co. Ltd.

- • Real Food Blends

- • Kate Farms Inc.

- • Victus Inc.

- • Global Health Products

- • Medline Industries Inc.

- • Nutritional Designs Inc.

- • Nutricia North America

- • Entend Nutrition

- • Nualtra Ltd.

- • Nestlé Novartis Medical Nutrition

- • Abbott Ross Products Division

- Recent Trends

- Plant-based and Vegan Formulas – Increasing consumer preference for dairy-free, plant-derived proteins.

- Sugar-free and Low-carb Solutions – Designed for diabetic and metabolic disorder patients.

- Portable Ready-to-use Packs – Single-serve, sterile pouches for convenience and safety.

- Clinical Trials for Condition-specific Nutrition – Continuous R&D to support medical efficacy.

- Integration with Digital Platforms – Apps and connected devices to monitor nutrition intake remotely.

- Future Outlook (2025–2033)

- The enteral feeding formulas market is expected to grow at a CAGR of 7–9% during 2025–2033, fueled by:

- • Increasing global prevalence of chronic illnesses.

- • Growing demand for home-based care.

- • Product diversification with condition-specific solutions.

- • Expansion in emerging economies with improving healthcare infrastructure.

- By 2033, enteral feeding formulas will evolve into highly specialized, personalized nutrition solutions, integrating biotechnology, AI, and sustainable practices. Companies will focus not only on addressing medical needs but also on promoting preventive healthcare.

- Conclusion

- The enteral feeding formulas market is witnessing transformative growth, shaped by healthcare needs, innovation, and demographic shifts. With rising incidences of chronic diseases, aging populations, and a growing emphasis on patient-centric care, the demand for enteral nutrition will continue to expand globally.

- Advancements in disease-specific and plant-based formulations, coupled with supportive government policies and digital healthcare integration, are set to redefine the market landscape. While challenges such as high costs and limited access in developing regions remain, the industry’s trajectory points toward robust growth and innovation over the next decade.

Related Posts

© 2025 Invastor. All Rights Reserved

User Comments