Drug-Eluting Balloons vs. Stents: Market Insights and Growth Opportunities

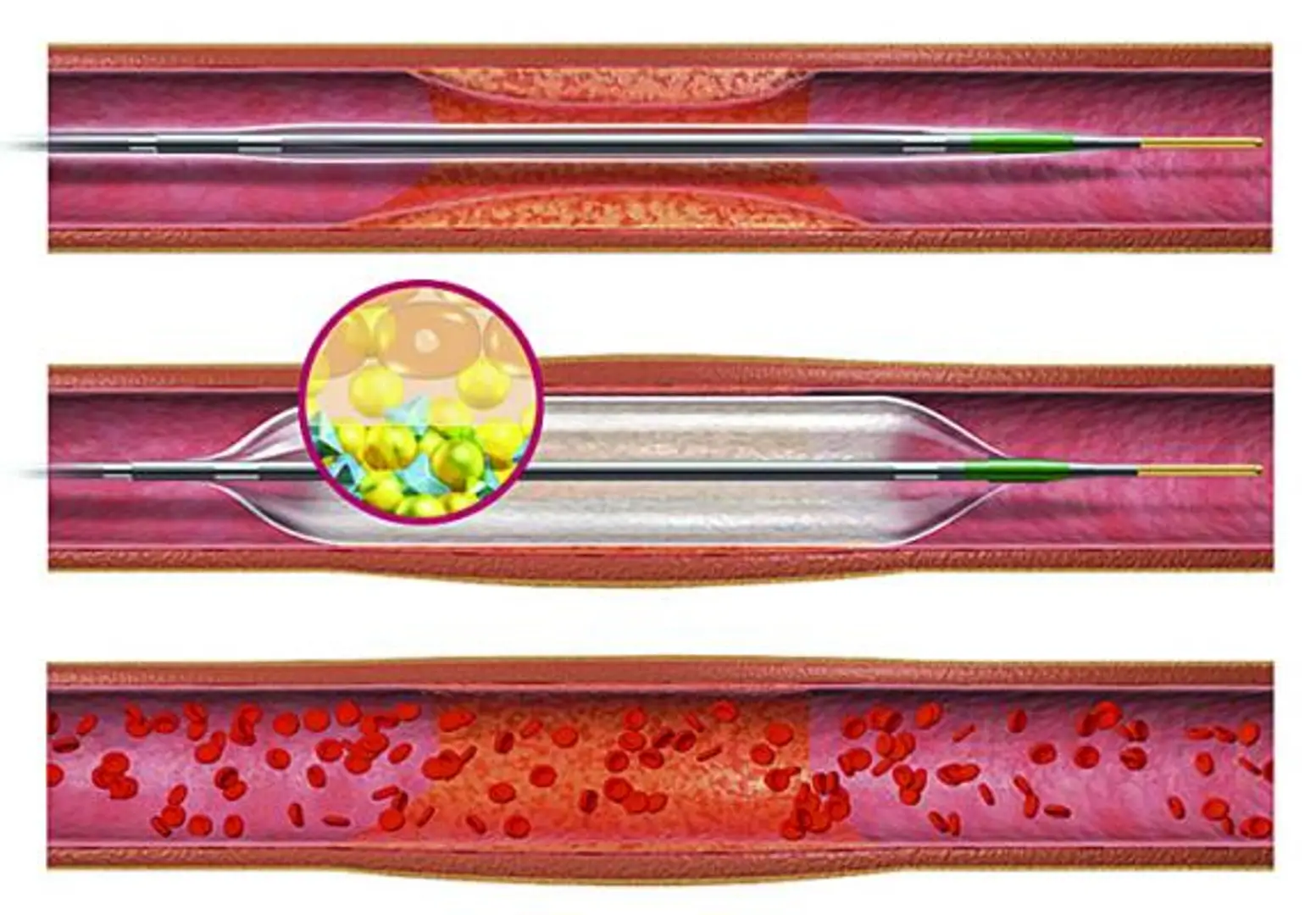

The Drug-Eluting Balloons (DEB) market is rapidly gaining attention as an advanced interventional cardiology solution. Designed to deliver anti-proliferative drugs directly to the arterial wall, DEBs combine the benefits of balloon angioplasty with localized drug therapy. They are widely used in treating coronary artery disease (CAD) and peripheral artery disease (PAD)—two conditions that represent leading causes of global mortality.

Unlike traditional bare-metal stents (BMS) or drug-eluting stents (DES), DEBs provide a stent-less therapeutic alternative, reducing long-term complications such as restenosis, late thrombosis, and vessel inflammation. The technology is especially useful in small vessel disease, bifurcation lesions, and in-stent restenosis, where conventional methods face limitations.

Between 2025 and 2033, the DEB market is expected to witness robust growth, fueled by rising cardiovascular disease prevalence, an aging population, technological advancements, and increasing demand for minimally invasive procedures.

This article provides a comprehensive outlook on the Drug-Eluting Balloons Market, including drivers, restraints, opportunities, competitive landscape, regional analysis, and future trends.

Click Here to Download a Free Sample Report

Market Overview

The DEB market has evolved from niche applications to a mainstream therapeutic approach. Initially considered a complementary option to stenting, DEBs are now recognized as a standalone therapy in specific cases.

Market Size & Growth

• The global Drug-Eluting Balloons Market is projected to grow at a CAGR of 8–10% from 2025 to 2033, reaching several billion dollars in valuation.

• The growth is driven by the high burden of cardiovascular diseases—with WHO estimating 17.9 million annual deaths globally from CVDs.

• The increasing use of endovascular procedures, supportive clinical trial data, and regulatory approvals are accelerating adoption.

Key Market Drivers

- Rising Cardiovascular Disease Burden

- Cardiovascular diseases remain the number one cause of death worldwide, fueled by sedentary lifestyles, obesity, diabetes, and hypertension. As more patients require revascularization procedures, demand for effective and safe solutions like DEBs rises.

- Minimally Invasive Treatment Demand

- Patients and healthcare providers increasingly prefer minimally invasive procedures with shorter recovery times, reduced hospital stays, and lower complication risks. DEBs, which eliminate the need for permanent implants, align perfectly with this trend.

- Clinical Advantages of DEBs

- DEBs provide uniform drug delivery without leaving a foreign body behind, reducing risks of restenosis, thrombosis, and chronic inflammation. They also allow repeat treatments, which are often challenging with stents.

- Technological Advancements

- Innovations in drug formulations, coating technologies, and balloon catheter designs enhance the efficiency and safety of DEBs. Advances in paclitaxel and sirolimus-based DEBs are broadening treatment applications.

- Aging Population

- With a growing global elderly population, cases of atherosclerosis, PAD, and CAD are rising significantly. Elderly patients often benefit more from DEBs due to fewer long-term complications compared to stents.

- Market Challenges

- High Costs – DEBs are costlier than conventional balloon angioplasty, limiting adoption in developing regions.

- Limited Awareness Among Clinicians – Many interventional cardiologists still prefer stents due to familiarity and established protocols.

- Reimbursement Barriers – Inconsistent insurance coverage in several regions restricts access.

- Clinical Data Variability – While many trials show positive outcomes, some studies indicate limited superiority over stents, creating hesitancy.

- Regulatory Hurdles – Strict regulations and lengthy approval timelines slow new product launches.

- Opportunities

- Sirolimus-Coated Balloons – New-generation sirolimus DEBs are emerging as promising alternatives, expanding the therapeutic portfolio.

- Peripheral Artery Disease (PAD) Applications – Growing PAD cases in diabetic and elderly patients open significant market potential.

- Emerging Markets – Asia-Pacific, Latin America, and Middle East countries are investing in advanced healthcare, creating demand for DEBs.

- Combination Therapies – Pairing DEBs with imaging technologies like IVUS and OCT enhances treatment precision.

- R&D Investments – Pharmaceutical and medtech companies are investing heavily in novel formulations, extended drug-release balloons, and biodegradable options.

- Applications of Drug-Eluting Balloons

- Coronary Artery Disease (CAD)

- • Used in small vessel disease, in-stent restenosis, and bifurcation lesions.

- • Offers an alternative for patients at high risk of stent-related complications.

- Peripheral Artery Disease (PAD)

- • Widely applied in femoropopliteal lesions and below-the-knee arteries.

- • Provides improved long-term patency compared to plain balloon angioplasty.

- Specialty Applications

- • Renal arteries, carotid arteries, and other niche areas are under exploration.

- • Emerging role in diabetic patients with high restenosis risks.

- Regional Insights

- North America

- • Dominates the market due to high cardiovascular disease burden, advanced healthcare infrastructure, and favorable reimbursement in the U.S.

- • Strong presence of key players and ongoing clinical trials support growth.

- Europe

- • Early adopter region with CE-approved DEBs widely used in CAD and PAD cases.

- • Germany, Italy, and the UK are leading markets.

- Asia-Pacific

- • Fastest-growing region due to rising healthcare investments, expanding insurance coverage, and high prevalence of diabetes and PAD.

- • China, Japan, and India are driving adoption.

- Latin America & Middle East

- • Growing demand for minimally invasive procedures and modern cardiovascular treatments.

- • Economic barriers and limited access remain challenges, but opportunities exist in Brazil, Mexico, and UAE.

- Competitive Landscape

- The market is moderately consolidated with both global medtech giants and specialized players competing. Strategic collaborations, mergers, and acquisitions are common as companies expand portfolios and geographical reach.

- Key Players Include:

- Medtronic, Boston Scientific Corporation, B. Braun Melsungen AG, Koninklijke Philips N.V., Terumo Corporation, Abbott Laboratories, Biosensors International Group, Biotronik SE & Co. KG, Cook Medical, Concept Medical, Cardionovum GmbH, Acotec Scientific, Surmodics Inc., Blue Medical Devices, Magic Touch (Concept Medical), Eurocor GmbH, Hexacath, MedAlliance, iVascular, Qualimed.

- Future Trends (2025–2033)

- Shift Toward Sirolimus-Coated Balloons (SCBs): Expected to replace paclitaxel-based balloons in several applications due to better efficacy and safety.

- Integration with Imaging Technologies: Use of DEBs with intravascular imaging will improve lesion assessment and drug delivery precision.

- Personalized Medicine Approach: Tailored DEB therapies based on patient-specific conditions and biomarkers.

- Growing Adoption in Emerging Markets: Government investments in healthcare will expand market access.

- Next-Generation DEBs: Biodegradable, nanotechnology-enhanced coatings, and longer drug-release platforms will define the future.

- Conclusion

- The Drug-Eluting Balloons Market is set for significant growth as cardiovascular disease prevalence surges globally. DEBs represent a promising solution that blends minimally invasive techniques with localized drug delivery, offering superior outcomes in cases where traditional stents fall short.

- Despite challenges like high costs, reimbursement issues, and regulatory complexities, the future of DEBs looks bright. Advances in sirolimus-based balloons, integration with imaging, and expansion into emerging markets will shape the next phase of growth.

- By 2033, DEBs will play a central role in interventional cardiology and peripheral vascular treatments, redefining standards of care and improving patient outcomes worldwide.

Related Posts

© 2025 Invastor. All Rights Reserved

User Comments